Forex News Trading Strategy Pdf

Many short-term traders base their decisions solely on technical analysis and price charts, regardless of which markets they are trading. Information technology's mutual for traders to completely ignore central factors and instead follow price trends, analyse support and resistance levels and weigh up various signals from technical indicators.

Notwithstanding, central analysis is just every bit of import in the modern trading world as technical analysis. News releases such every bit earnings reports and changes to involvement rates and inflation can significantly impact the markets. Trading on news releases tin, therefore, bear witness vastly beneficial to traders and tin can significantly strengthen their trading strategy by adding economic announcements to their purely technical and charting approach. Learn how to trade the news and spot potential trading opportunities within the financial markets.

How to read news for trading

In order to read news events, you should familiarise yourself with economic indicators, which are macroeconomic factors that have an impact on all financial markets, whether it be forex, shares or indices. These can include changes to interest rates, inflation, unemployment levels or retail income for a specific country and these all take a significant effect on the fiscal markets and overall land of the economy.

Economic announcements often involve these particular factors when advising traders of recent changes within the markets. This tin have an bear on on market sentiment, especially if the data annunciation is non in line with what the traders had been expecting.

News trading strategy

A news trading strategy involves trading based on market expectations, both before and later a news release. Trading on news announcements can crave you to make quick decisions, every bit the financial markets may be impacted nigh immediately. Therefore, you will need to make quick judgements on how to merchandise the announcement.

When trading on news releases, information technology is important that you are aware of how financial markets work. Sometimes news is already factored into the avails price. This happens considering traders try to predict the results of hereafter news announcements and then, in turn, the market responds by irresolute the price of an asset. News-based trading is especially useful for volatile markets, for instance oil trading.

Read more near using cardinal assay in the consideration of external factors every bit part of your news trading strategy.

How to merchandise the news

- Register for an business relationship with CMC Markets. You will have access to a demo account directly away to practise with virtual funds before depositing funds and placing live trades.

- Keep up to date with the fiscal markets. Our news and analysis section is updated daily with articles on the forex, share, treasury, article and index markets, written by our marketplace analysts.

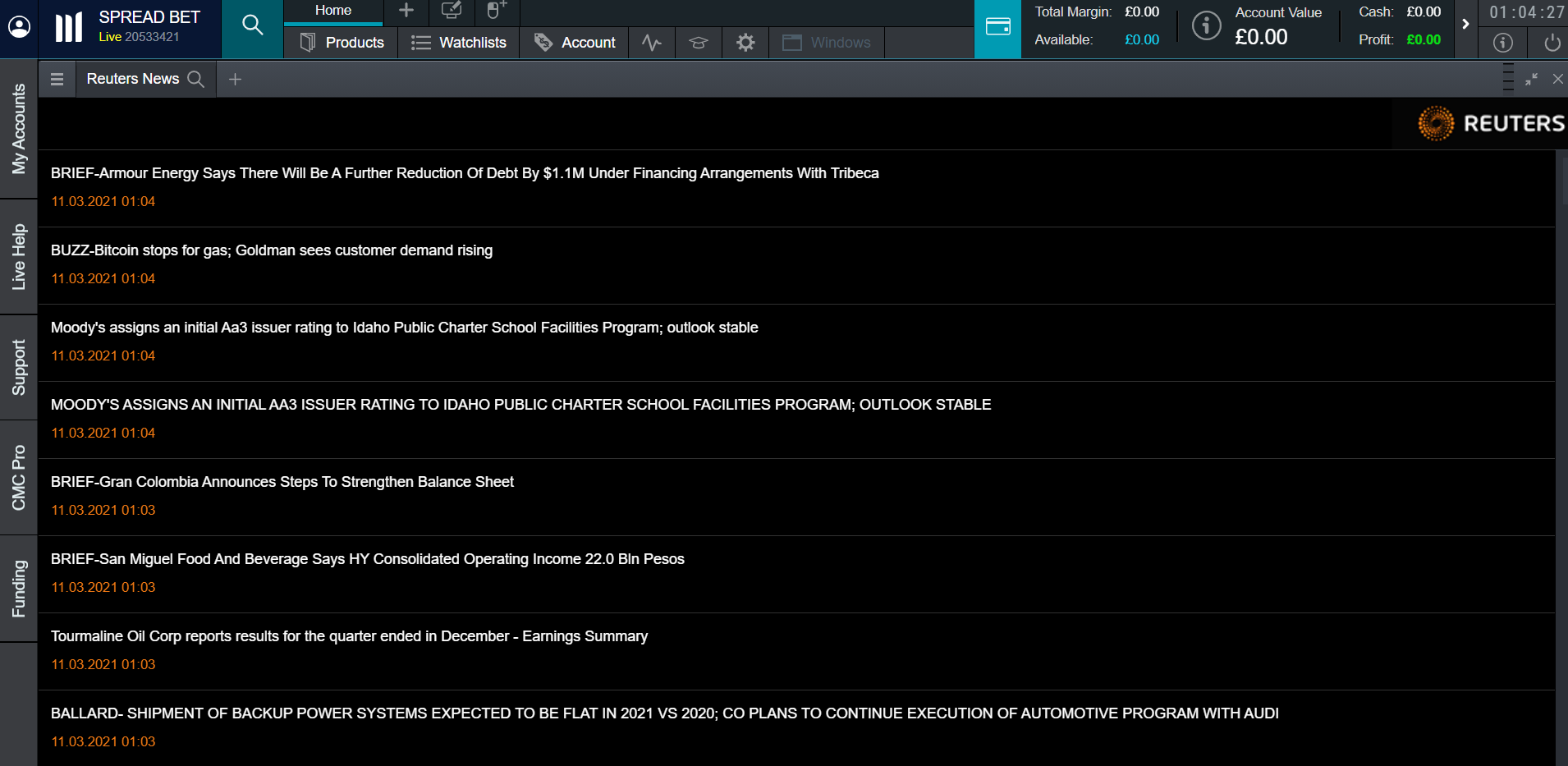

- Make the most of our exclusive news and insights tools. A live account will give yous access to Morningstar equity research reports and Reuters news headlines, which provide a wealth of information for all nugget classes..

- Research advisable trading strategies for your market. Our guide to the most common trading strategies involves long-term fundamental strategies and short-term price activeness strategies.

- Expect at combining cardinal and technical practises. These two types of analysis may be more effective when used together, rather than solely relying on 1 for all trading decisions.

Trade the news in forex

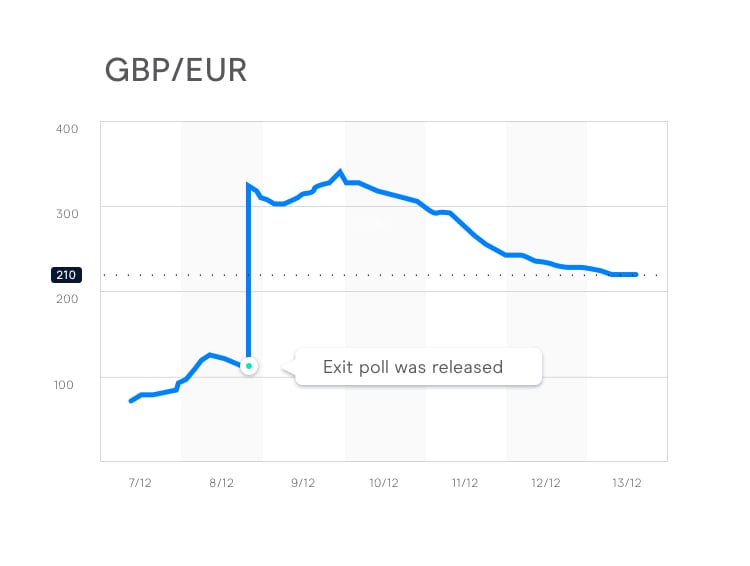

As with other nugget classes, forex trading news tin can become particularly agile before and following major economic events. However, there are significant differences betwixt the type of news that sets apart currencies from other fiscal markets.

Forex markets tend to respond the most to macroeconomic news – the kind of developments that reflect or impact broad economies. Generally speaking, forex traders can look at economic news to appraise its impact on interest rates and budgetary policy. News that suggests a more hawkish (ambitious) primal bank tends to button forex pairs upward in value relative to other currencies, while dovish (peaceful) news can cause a currency to depreciate.

Currencies of countries that are major exporters of raw materials or commodities tin can be impacted past news forex trading news, as this affects the prices of the master commodities that they produce. These currencies are often referred to as resource currencies. Prices of commodities that affect these currencies can be influenced by issues affecting supply and demand.

On the supply side, news that suggests a lower supply can push up prices, while news that suggests higher supply tin can depress prices, which tin and so impact related currencies. News that could reverberate changes in supply may cover political tensions, wars, terrorism, weather, economical sanctions, labour relations (strikes) and more. Speculation and pricing related to demand is mainly influenced by many of the same major news releases noted above, plus commodity inventory reports and outlooks.

Forex news trading strategy

In order to come up upwards with a comprehensive forex trading strategy using news releases, forex traders tend to look out for sure key forex indicators that can have an touch on interest-rate speculation, including:

- Central bank decisions and speeches

- Inflation rates

- Gross domestic production (GDP) figures

- Employment figures

- Trade balances

News related to market sentiment can also influence currency trading, particularly those considered to exist safe havens, including the commodity gold, as well as major currencies USD, JPY and CHF. These currencies tend to concenter capital during times of turmoil and see outflows when the fiscal markets settle downwardly.

News that tin impact chance-on, risk-off trading includes stock market returns and volatility, financial stresses at the national or continental level, political turmoil, elections, treaty negotiations and other broad news beyond economical data and central banks. Recent examples include the Greek debt crisis and China market turmoil.

Forex news trading predictions

Traders should be aware that demand for many commodities – and therefore the commodity's price – rises and falls with the seasons. Seasonal forex trading news and impacts tend to exist seen in energy and agricultural commodities, simply less and then for precious metals. The table below shows some of the master resource currencies and the commodities that affect them. These can be used by traders equally a sort of forex news trading point, as information technology can help to predict where the toll of the currency is headed.

| State | Currency pair | Commodity product |

|---|---|---|

| Canada | USD/CAD | WTI rough oil and metals |

| Australia | AUD/USD | Base metals and grains |

| New Zealand | NZD/USD | Livestock and dairy |

| Norway | USD/NOK | Rough oils |

| Sweden | USD/SEK | Metals and woods products |

| S Africa | USD/ZAR | Precious metals |

| Russia | USD/RUB | Rough oil, natural gas and metals |

How to utilise news to trade stocks

Stock trading based on news releases is a strategy used past many long-term investors, as well as brusk-term traders. If a company has potent remainder sheets, cash flows and earnings reports consistently, then a trader may decide to buy and agree the share for a longer flow of fourth dimension.

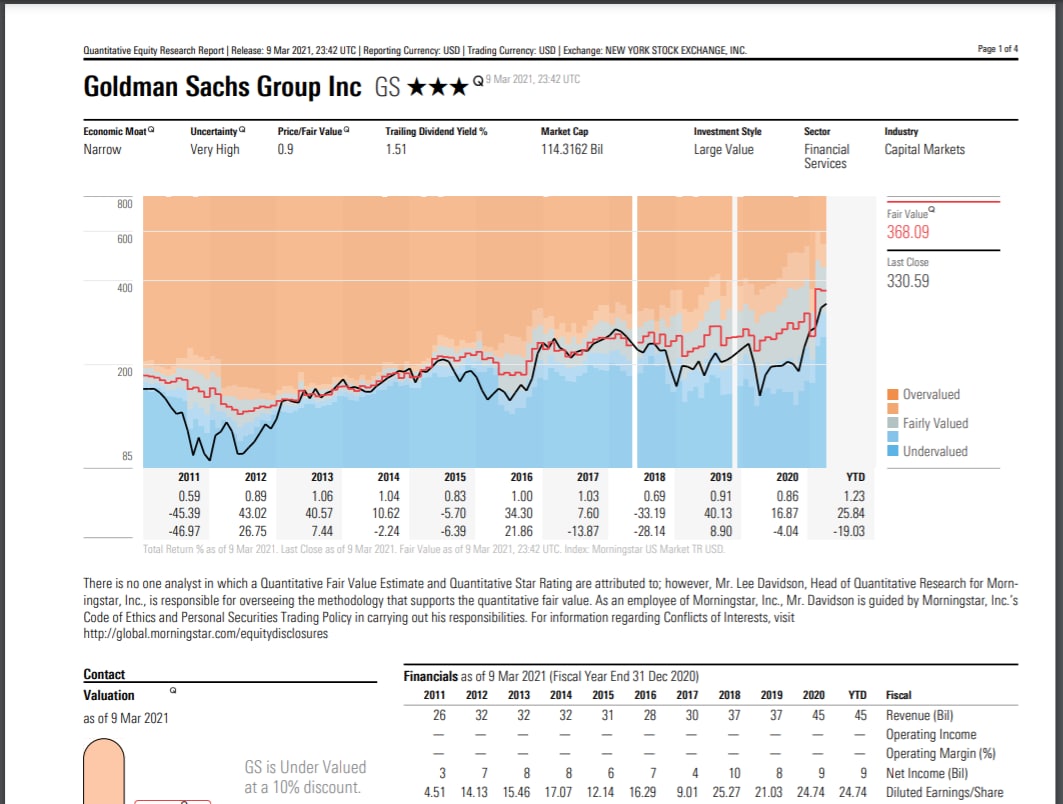

All the same, if a company releases a report with considerably lower financials than expected, this tin can cause a rally for traders to short the stock equally its value is decreasing. Traders tin perform visitor assay before deciding whether to invest in a stock. This includes analysing its growth rate potential, besides as any potential legal, political or insolvency risks. Fiscal ratios such every bit toll/earnings forth with dividend yields tin also indicate whether a stock is a salubrious investment right now.

Our Morningstar equity research reports are updated regularly with new information about company fundamentals. These are available for a wide range of shares on our platform and can as well indicate whether they are considered to be overvalued, fairly valued or undervalued within the stock market place. This data may help traders to brand a determination on whether to enter a position or not. Annals for a live business relationship now to admission our Morningstar reports.

In general, news that has a significant affect on private company shares may not have a major impact on currencies. Stock market news that has piffling or no impact on currencies includes earnings reports, management changes, mergers and acquisitions and partnerships. Therefore, it may be easier for some to make more than reliable forex news trading predictions on how the market place will perform.

News trading signals

Some brokers offer automated news trading signals that can assistance a trader to make decisions on whether to enter, exit or avoid a merchandise. These hints are based on price fluctuations later a certain type of news release and tin can prompt traders to either buy or sell an nugget.

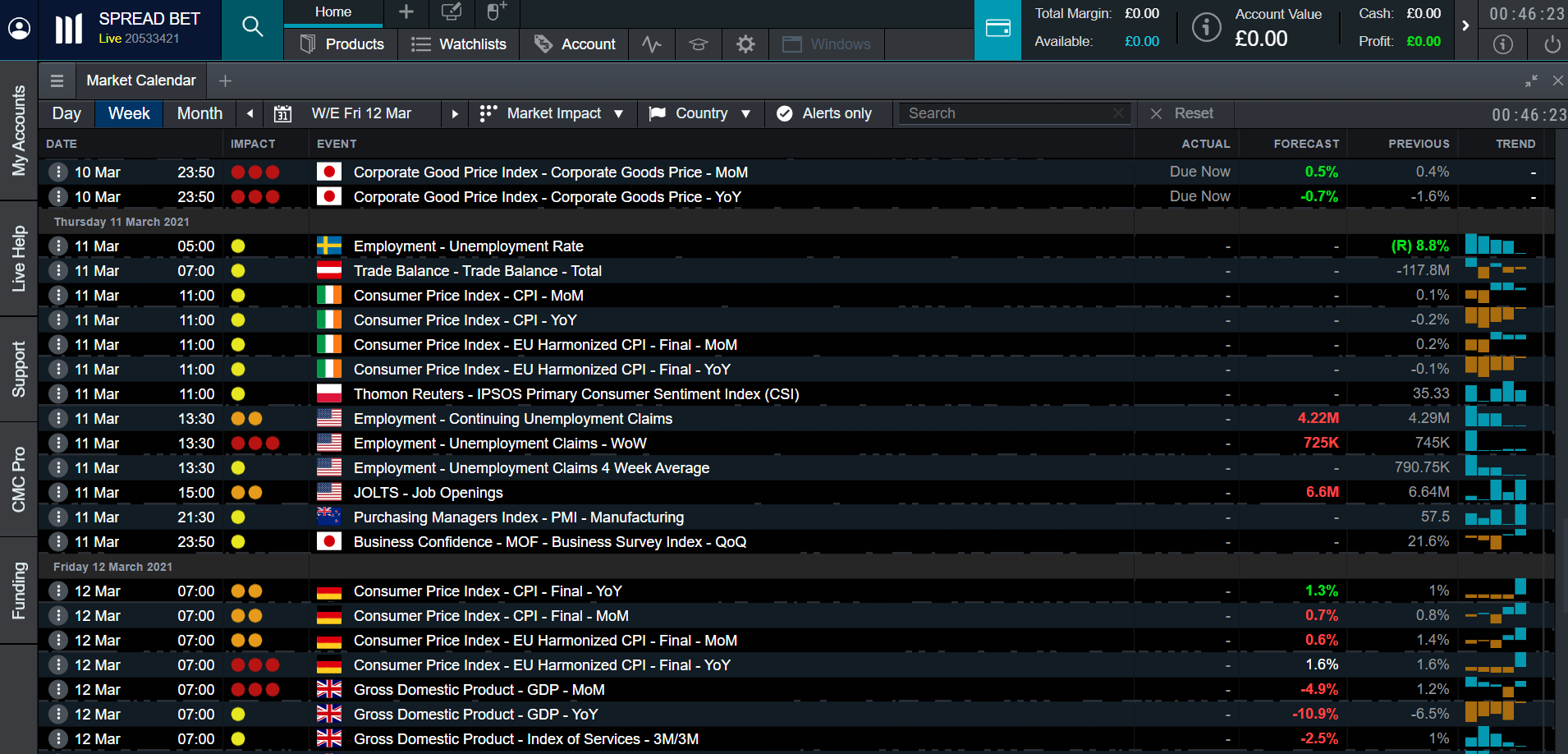

A manual alternative is to monitor upcoming tradeable events using our economic calendar. This feature tin can be found on our Next Generation platform and highlights events such as unemployment reports, Gross domestic product, CPI and PPI figures, as well every bit trade reports and sentiment surveys. These events tin all have an effect on market place sentiment and cause major toll swings within the financial markets.

Our market place calendar tin be customised by date, market impact (low to high) and country, and so y'all can filter these to be more than relevant for the asset or market that you are interested in trading. Yous tin can as well set alerts for individual events that you lot wish to monitor.

Trading news releases: what are the benefits?

It can aid to increase volatility

Sure major economic announcements tin can bring boosted volatility in the markets, even if it is for just a short period of time. Even the neatest forex or stock chart patterns tin temporarily be thrown out of sync past a significant trading announcement, such as the latest unemployment news or changes to involvement rates or inflation from a nationwide bank.

Paying attention to when trading announcements are due can hateful that you end upwardly placing a carefully planned trade just before a major event happens, which instantly triggers your finish-loss. It may be more than opportune to wait to open new positions subsequently news events have taken place, and and so come across if the reason for the trade is still valid.

It can trigger unexpected market reactions

In that location is ordinarily a consensus amid leading economists well-nigh what level an economical proclamation is probable to come in at. Changes to non-farm payrolls, GDP or inflation data will have a resulting effect on the market. For example, depression unemployment suggests a strong economy, so many would await the stock marketplace to rising. A decision to lower interest rates could brand a country's currency less attractive, causing it to fall against other world currencies.

From time to time, however, economic announcements are very different from what the broader market place was expecting, and this tin cause an reverse market place reaction. For example, if a central bank hints that rate cuts may be coming, but the currency still rises, in that location could exist other factors in addition to the prospect of interest rate changes. This could, in plow, prove to be a strong 'buy' signal. If the currency does not driblet on an expectation of a fall in interest rates, so positive sentiment is strong, and this could possibly betoken that information technology is at present a buyer'due south market.

Information technology tin betoken that trends are changing

Many traders try to place trends in the hope of turn a profit. Such trends could range beyond minutes, days or even months. Merely well-nigh trends reverse at some betoken, and a change in the underlying economics could be the outset sign of this.

Every journey starts with a unmarried step and this is truthful of trend reversals every bit well. An economical announcement is rarely plenty to speedily change a medium-term trend, only how the market reacts to surprises can requite the first clue that sentiment is starting to shift. This offers traders an opportunity to open positions at the very first of a new trend.

Seamlessly open and close trades, track your progress and gear up alerts

Risks of news trading

Of course, there are drawbacks of news-based trading as well. In particular, news trading requires proficient primal assay skills, as you lot will need to sympathize how sure economic announcements tin can affect your positions and the wider financial marketplace.

There is also the risk of carrying positions for a longer menstruation of time. If the news release requires a few days or weeks to materialise, your trading positions may be open over several days. This brings overnight take chances and may require you to pay additional belongings costs. Therefore, traders should ensure that they have sufficient funds in their account to cover these costs.

How to become started trading market news

Open up an account with CMC Markets to access our multitude of news and assay tools. Information technology is wise to keep up to date with the e'er-changing fiscal markets. Yous tin can choose to trade on news reports through either a spread betting or CFD business relationship, so read our commodity almost the differences between spread bets and CFDs to get started.

News trading software

As discussed, our online trading platform, Next Generation, releases regular news and analysis articles for all financial markets. We too provide fundamental analysis reports from Morningstar, too equally market commentaries and updates from Reuters news on our news and insights section of the platform. Past following our news, this ensures that you are always up-to-date with the latest trends and changes within the financial markets, as well as general economic announcements.

Our award-winning platform* is available for mobile and tablet devices, including iOS and Android systems. Complete with all the regular charting features, these mobile applications make it easy to merchandise and monitor news announcements on-the-go. You tin also set up trading alerts for both desktop and mobile and choose to receive push notifications via the app, e-mail or SMS. Reading more nearly our trading alerts.

*No1 Web-Based Platform, ForexBrokers.com Awards 2020; Best Telephone & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD & FX traders, Investment Trends 2020 Britain Leverage Trading Report; Best Platform Features & Best Mobile/Tablet App, Investment Trends 2019 UK Leverage Trading Study.

Source: https://www.cmcmarkets.com/en/trading-guides/trading-the-news

Posted by: douglasraides.blogspot.com

0 Response to "Forex News Trading Strategy Pdf"

Post a Comment