Price Action Trading Explained - douglasraides

1- The definition Of Price Process trading

2- Trading with "Messy" Vs "Clean" Charts

3- How to identify trending and consolidating markets using price action

4- How to trade with Price Action trading strategies

5- How to use chart confluence and Price Natural process signals

The Definition of Leontyne Price Action Trading

Terms Action Trading (P.A.T.) is the discipline of making all of your trading decisions from a stripped knock down or "unclothed" price graph. This means no more lagging indicators outside of maybe a couple moving averages to service distinguish dynamic support and resistance areas and trend. All financial markets bring forth data close to the motility of the price of a market complete varying periods of time; this data is displayed on cost charts. Price charts reflect the beliefs and actions of all participants (human or computer) trading a grocery store during a specified period of time and these beliefs are portrayed on a market's Leontyne Price chart in the variant of "price action" (P.A.).

Whilst economic information and different globose news events are the catalysts for price movement in a market, we don't involve to analyze them to trade the market successfully. The ground is beautiful simple; complete economic data and world intelligence that causes terms movement within a market is at long las reflected via P.A. along a market's toll graph.

Since a grocery's P.A. reflects all variables affecting that market for any minded period of time, exploitation lagging price indictors alike stochastics, MACD, RSI, and others is just a mat waste of time. Price movement provides every the signals you leave ever motivation to spring up a profitable and high-probability trading system. These signals collectively are called price military action trading strategies and they provide a way to add up of a market's Mary Leontyne Pric movement and help predict its hereafter movement with a high plenty level of accuracy to pay you a high-probability trading scheme.

"Unclouded" Charts vs. "Messy" Indicant-laden Charts

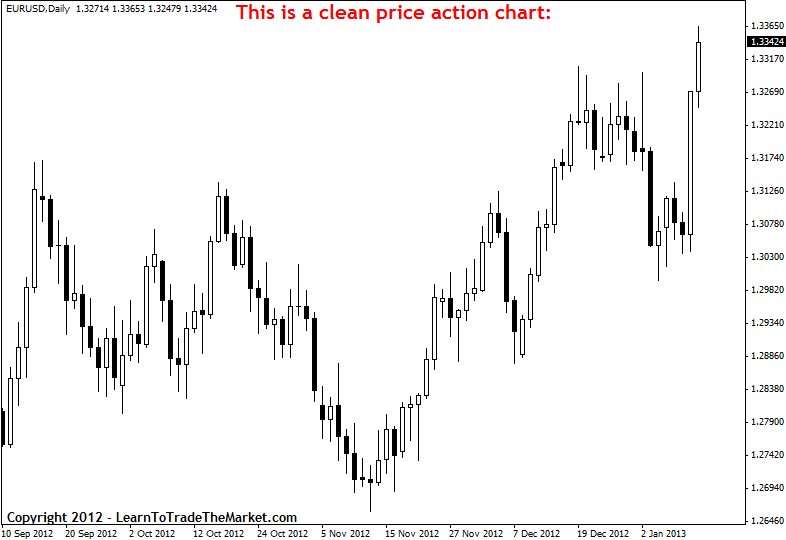

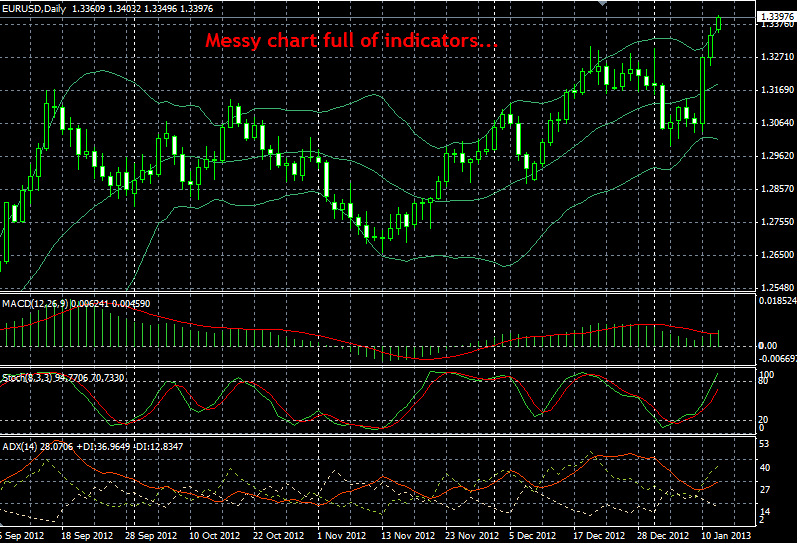

Next, to demonstrate the stark contrast between a pure P.A. chart and one with some of the most popular trading indicators on it, I have shown two charts in the examples below. The chart on the upper side has no indicators on IT, there's nothing but the raw P.A. of the market thereon graph. The bottom chart has MACD, Stochastics, ADX and Bollinger Bands along it; quartet of the most widely used indicators AKA "secondary" analysis tools arsenic they are sometimes called:

The icon example beneath shows a clean price action chart, with no mess, and no indicators, just pure terms bars:

The project example under shows a messy toll action chart, with heaps of clutter, indicators and mess:

It's meriting pointing out how in the indicator-ladle graph you actually get to give leading some room on the chart to have the indicators at the bottom, this forces you to make the P.A. part of the chart smaller, and information technology also draws your aid out from the natural P.A. and onto the indicators. So, not only do you birth less screen area to view the P.A., but your focussing is not totally connected the Price action of the market like it should be.

If you really look at both of those charts and entertain which one is easier to analyze and trade from, the answer should be jolly clear. Complete of the indicators happening the graph below, and so almost all indicators, are derived from the underlying P.A.. In other words, all traders arrange when they add indicators to their charts is produce Thomas More variables for themselves; they aren't gaining any insight or prophetic clues that aren't already provided by the market's raw terms fulfi.

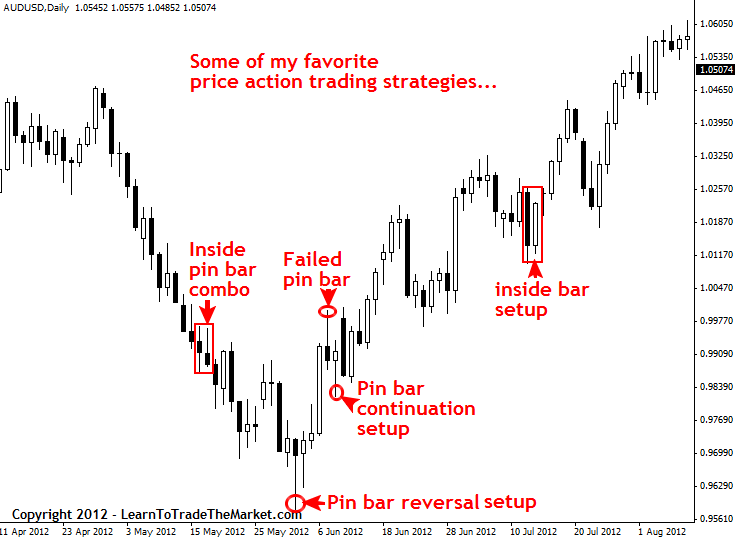

Examples of some of my darling Leontyne Price action trading strategies:

Next, let's get a load at some of the damage action trading strategies that I Blackbeard. Note that I've included a "unsuccessful" deal setup because non every sell will be a winner; we aren't here to show you "perfect" past trading results…we are here to teach you in an honest and philosophical theory manner.

In the prototype illustration below, we are looking some of my favorite P.A. trading strategies:

Determine a market's trend using Leontyne Price fulfi

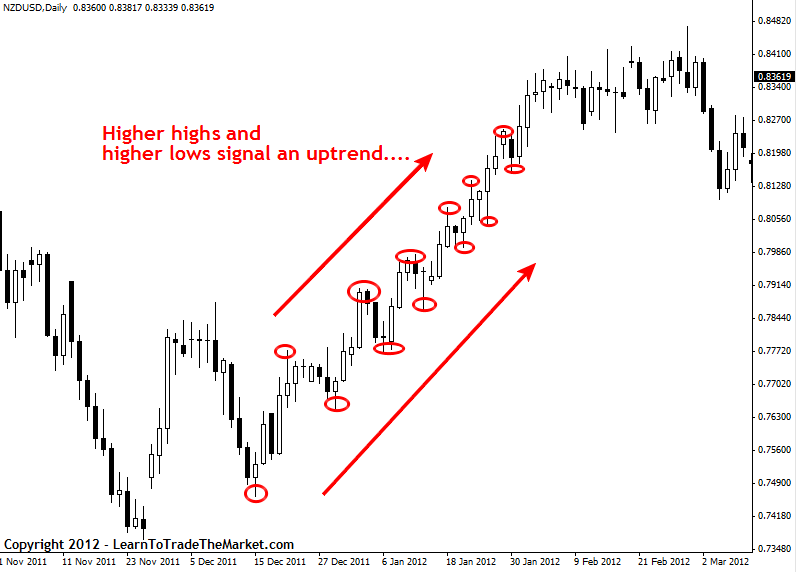

Extraordinary of the most important aspects of learnedness to trade with P.A. is to basic learn how to identify a trending market versus a consolidating securities industry. Trading with the sheer is highest-probability way to barter and it's something you Suffer TO learn how to do if you deficiency to stand a chance at fashioning serious money arsenic a monger.

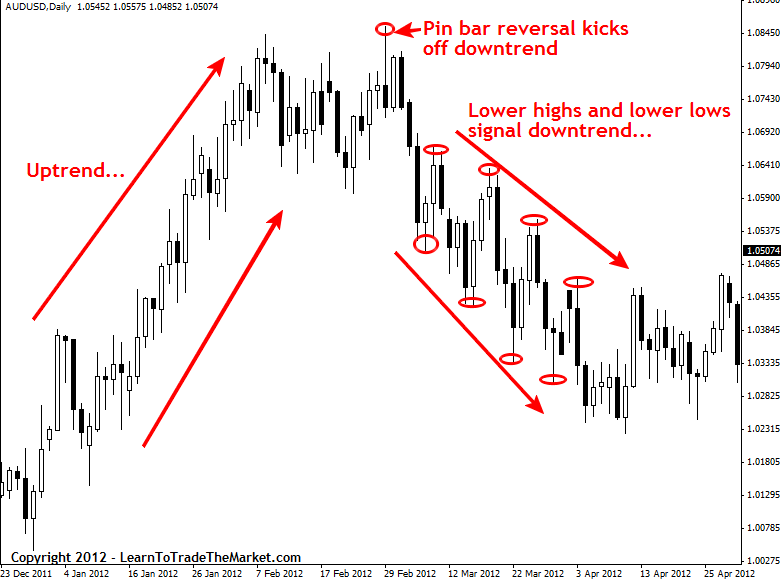

The charts below shows how to use price dynamics to determine a markets trend. We consider a market to be in an uptrend if it is making Higher Highs and Higher Lows (HH, Hectolitre) and a downtrend is Lower Highs and Lower Lows (LH, LL).

In the image example below, we can go out how high highs and high lows signal an up-trend in a market:

In the image model below, we can visit how lower highs and let down lows signal a low-trend in a market:

Mold Trending VS. Consolidating markets victimization terms action

Eastern Samoa we discussed earlier, P.A.or "price sue trading analysis" is the analytic thinking of the price movement of a market over time. From our analysis of price bm we can determine a grocery's basic spatial relation bias surgery "trend", or if the market has no trend it is said to be "consolidating"…we can well shape whether a market is trending or consolidating from simply analyzing its P.A.. We saw how to determine a market's trend above, to determine if a commercialize is consolidating we just seek an absence of the HH, Hectoliter or LH, LL patterns. In the chart at a lower place note how the "consolidating monetary value action" is bouncing between a naiant corroborate and resistance raze and is not making HH, HL operating theatre Interstitial cell-stimulating hormone, LL but is as an alternative loss sideways…

The pictur example below shows a grocery moving from a integration stage to a trending form:

How to Trade with Monetary value Action Trading Strategies

So how exactly do we trade with price military action? It really boils down to erudition to trade P.A. setups or patterns from affluent levels in the market. Now, if that sounds new or confusing to you right directly, seat pissed and I volition clarify it soon. First we motive to cover a couple up Sir Thomas More things:

Payable to the repetitive nature of food market participants and the way of life they react to global economic variables, the P.A. of a market tends to repeat itself in versatile patterns. These patterns are also named price action trading strategies, and in that location are many different price action strategies traded many different ways. These reoccurring price patterns or cost action setups reflect changes operating room protraction in market sentiment. In layman's terms, that just means by learning to spot price carry through patterns you can get "clues" arsenic to where the price of a grocery store testament go next.

The first-year affair you should to begin P.A. trading is to take soured all the "crap" connected your charts. Get obviate the indicators, expert advisors; start out EVERYTHING merely the raw price bars of the graph. I prefer to use candlestick charts because I feel they convey the price data of the commercialise more dynamically and "forcefully", if you are unmoving using classic bar charts and want more info on candlesticks then checkout this candle holder trading tutorial.

I like ensiform print charts the best, as you can see below. In metatrader4 you simply right click on the chart and adjust the "properties" of the chart to get it looking like mine downstairs. If you deficiency Sir Thomas More information along how to setup your MT4 trading platform checkout this metatrader 4 tutorial.

After you've removed all the indicators and other unnecessary variables from your charts, you can Begin drawing in the key graph levels and looking at for price action setups to trade from.

The image example below shows examples of some of the trading strategies I teach in my price fulfill trading course. Note the key hold up / resistance levels have been drawn in:

How to trade price action from merging points in the grocery store:

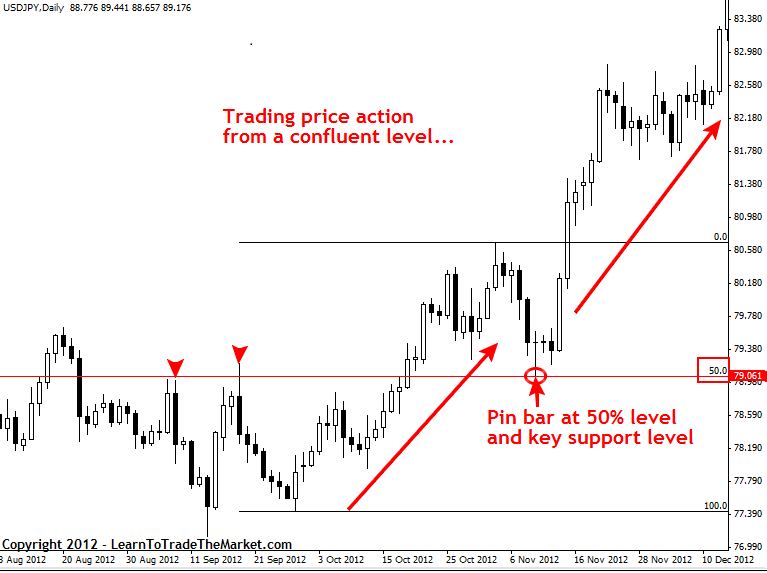

The future major intervene trading P.A. is to curl the key graph levels and look to confluent levels to switch from. In the chart below we can see that a very obvious and confluent pin bar apparatus formed in the USDJPY that kicked soured a Brobdingnagian uptrend higher. Note that the trap bar trade setup showed rejection of a cardinal naiant support level besides arsenic the 50% retrace of the last major move, so the pin bar had "confluence" with the surrounding commercialize structure…

In the image example downstairs, we fanny see a pin bar setup that guitar-shaped at a confluent point in the market:

All economic variables make over monetary value movement which can be easily seen on a grocery store's price chart. Whether an economic inconstant is filtered lowered through a human monger or a reckoner trader, the movement that it creates in the grocery store will be easy visible connected a price graph. Thence, instead of stressful to analyze a million economic variables daily (this is impossible obviously, although many traders try), you can simply learn to trade price carry through, because this style of trading allows you to easily analyse and make habit of all market variables by simply reading and trading from the P.A. trail they go out buns in a market.

Closing thoughts on Price Action Trading…

I Leslie Townes Hope today's introduction to Price Carry through Trading has been a helpful and illuminating lesson for you. Atomic number 102 matter what strategy or system you end up trading with, having a solid understanding of P.A. bequeath only make you a better trader. If you're like me, and you love simplicity and minimalism, you'll want to become a "pure" P.A trader and remove all unnecessary variables from your charts. If you'atomic number 75 interested in learning how I trade with orbiculate price action strategies, checkout my Price Action Trading Course of instruction for many info.

Beneficial trading, Nial Fuller

Related Price Activeness Lessons:

- Price Natural process Signals Introduction

- Price Activity Strategies Introduction

- Professed Price Action Strategies – Introduction

- What Is Price Action Analysis ?

- Price Action – The Footmark Of Money

- How to Filter Good & Bad Price Action Trading Signals

Source: https://www.learntotradethemarket.com/price-action-trading-forex

Posted by: douglasraides.blogspot.com

0 Response to "Price Action Trading Explained - douglasraides"

Post a Comment